I got my first job when I was 14. At that age, I knew I wanted to buy a car when it was time to get my license. Two years’ worth of savings was just enough to purchase a bucket of rust. I named her Suzie. She lasted me less than a year — but she was my bucket of rust.

In those days, if you couldn’t afford dealership prices, or get approved for a loan, you were stuck with whatever the newspaper classifieds had listed for sale. Today, the internet makes shopping, financing, and closing a deal easier than ever.

New lenders pop up regularly, with the goal of helping consumers that have damaged credit to get them into a car, so they don’t end up with their own Suzie. If you have less-than-ideal credit but are in need of a new vehicle, we’ve done some of the legwork for you to identify some of the best auto loan providers for bad credit. Keep reading for our top picks.

Top Providers | Approval Tips | Down Payment Benefits

The Top Auto Loan Providers for Bad Credit

No matter your financial situation, you still need a car to get to and from work. The best way to improve your financial situation is to be mobile and able to commute.

We’ve done extensive research on the best lenders for car shoppers that have bad credit with no down payment. Loan terms differ depending on the total cost and terms of each loan, but all three have a vast history of working to approve borrowers with varying financial backgrounds and means of repayment. Below is a choice of the three best lenders that will work to meet your needs.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

2. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

- Prequalify in minutes without impacting your credit score

- Refinancing loans save an average of $191 per month

- 125% financing available for cash-out refis

- PenFed Credit Union membership required but can be applied for at the same time as your loan

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 5.19% and up | 1935 | 5 minutes | 8.5/10 |

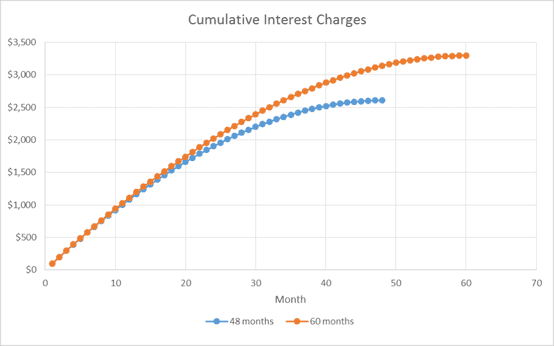

Your credit history and down payment directly affect the interest rate you’ll pay on your car loan, but they’re not the only factors in the cost of your loan. The average auto loan is 70 months, indicating that lenders are willing to extend loans to meet the payment needs of buyers — just remember that longer loans come with a price.

The longer your loan term, the more you’ll have to pay through both your rate and your long-term finance charges. Used cars often have higher rates, but the cheaper sale price limits how much you’ll pay over the life of the loan.

The graph shows how interest charges increase as the length of an auto loan extends.

Note that many lenders also have minimum income requirements for applicants. Most range between $1,500 and $1,800 in monthly W-2 income (meaning you’re a regular employee that receives a W-2 tax form at the end of each year). Be sure to check the standards for any lender you apply to before sending in an application.

Additionally, most bad credit auto lenders require any bankruptcies to be discharged through the court before the application is made. A few will consider lenders that have their 341 bankruptcy meeting completed.

Tips for Approval with No Money Down

Bad credit doesn’t have to be the nail in the tire of your car-buying dreams. Even if you’ve been approved for a loan, there are many steps that you can take to build out your financial profile and look better on future applications for credit.

1. Stay at Your Current Job as Long as Possible

Subprime lenders love to see a steady history of employment. It shows you can be trusted to make future payments. It also makes tracking income easier. The longer you’re at a job, the better it looks to banks. Regular changing of employment or careers can raise a dependability red flag.

2. Stay at Your Current Residence for at Least a Year

Much like employment, staying in one residence for an extended period makes applicants look more reliable. Your credit report shows previous addresses. If there’s a litany of changes made every few months, lenders may worry about finding you if you default on your loan. Staying in the same residence for more than a year also provides evidence of stability.

3. Open and Maintain a Personal Bank Account

This continues to play into the reliable and responsible adult category. Maintaining a bank account without overdrafts and regular deposits shows that you take care of your money and have an upward trend from your current credit woes. The balance doesn’t have to be large, it just has to be cared for.

4. Get Smaller Lines of Credit in Your Name and Pay the Bills Every Month

These could be secured credit cards, cellphone plans, or a small personal loan that requires monthly payments. Anything you can do to show a positive payment history will only help your cause down the road.

Even a Small Down Payment Can Have Big Financing Benefits

Car shoppers often think a down payment has to be a large portion of the vehicle’s final price, but dealerships are typically willing to take any amount down. Even $100 shows that you have some skin in the game and are serious about paying off the loan.

You could also look to decrease your purchase price (and your loan amount) by using a trade-in. If you have an old car — working or not — you can always attempt a trade to knock a little off the overall cost of your new ride. You can get an idea of your trade-in’s value for free online.

Lenders see the loans they extend as a partnership. They’re investing in you, and expect that investment to pay off in the form of repayment and interest charges. Whatever you can do to show them that you’re serious about the partnership will only work in your favor and get you closer to an approval.

Do the Math Before Signing the Dotted Line

When I was 16 and used my savings to buy my first car, I didn’t care about value, or miles, or any of the things you look for in a used vehicle. I just wanted a pair of keys that made an engine turn. My naivety is probably why local tow-truck companies kept me on their Christmas card list for the next year.

Shoppers today — regardless of credit history or down payment ability — have tools at their disposal that make shopping for a car easier than ever. Subprime lenders, like those suggested above, specialize in working with consumers that have bad credit and no down payment. The challenge is for the buyer to know exactly what they’re getting into before they sign for a loan.

Study the terms and interest charges being offered. Shorten the loan as much as you can while keeping the payment affordable. Most of all, remain diligent with your credit profile after you’ve left the lot with your new car. Make all payments on time, remain at your job and current address, and show a positive track record with all of your other bills. If you can manage to do that, your next car loan will be easier and the terms more favorable.

Most importantly, make sure the car you’re buying will last you beyond the life of the loan. Take it from someone that already made that mistake once. Rest in Peace, Suzie. You were a sweet ride.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.