If you’re searching for information on how to get a credit card, this article will walk you through some of the basics and provide information and recommendations for those with little to no credit history.

In the late 19th century, department stores and hotels began to issue charge coins to their loyal customers. These small coins, which could be slid onto key rings, allowed merchants to easily copy a customer’s store account number onto a sales slip.

While the modern plastic credit card looks little like its coin-shaped ancestor, its purpose remains remarkably similar: to make it easier to purchase items without cash.

Today’s cards have a number of improvements over those of yore, however, like the ability to be used just about anywhere. Getting a credit card can seem intimidating, especially if you have poor credit or lack an established credit history. Tons of great options are out there, though, and can be found with a little help. Let’s dive into the topic. We’ll look at how to increase your chances of being approved, concerns of consumers with bad credit or no credit, and some of our top choices for credit cards that may be helpful for those struggling with credit issues.

Get Approved | Bad Credit | No Credit | Secured Cards | Free Cards | How Long

1. How Can I Increase My Chances of Getting Approved?

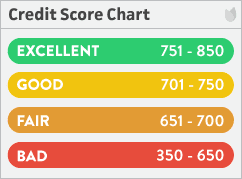

The approval process for any credit card can be made easier with a few simple steps. The first step is knowing where you stand. Pull your credit report and check your credit score. Lenders will be doing the same thing, and you’ll want to know what they will see.

If you find any errors on your credit report, such as an incorrect balance or unfamiliar account, now is the time to fix them. Don’t put this step off, as those errors could be dragging down your score. Use a good credit repair company to make the process as smooth as possible.

Once you know your situation, you can determine your credit card options. You’ll have the most success getting approved for a credit card when you already know you meet the criteria. If you aren’t sure if you’ll qualify, use the issuer’s website to check for pre-approval (also called pre-qualification) offers. This is an easy way to see which cards you’ll likely be approved for, without impacting your credit with a hard pull.

2. Can I Still Get a Credit Card with Bad Credit?

When your credit score dips below 650, most lenders will consider you to be a subprime borrower. Having bad credit is no reason to feel defeated before you’ve even begun, however. A lot of options are out there, including lenders who specialize in credit cards for those with poor credit.

While you’ll need to make peace with the higher-than-average interest rate that will likely come with your subprime card, you’ll still want to shop around for the best rates. Some cards will even come with perks, such as cash back rewards and free credit score tracking. Check out our top three credit cards for bad credit below.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 5 minutes | N/A | Yes | 9.5 |

- $400 credit limit doubles to $800! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply

- Monthly reporting to the three major credit bureaus

- Initial Credit Limit of $400.00 (Subject to available credit)

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 10 minutes | 29.99% | Yes | 7.5/10 |

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

+See More Credit Cards for Bad Credit

3. What Are My Options if I Have No Credit History?

Those who lack an established credit history will find it almost as difficult to get a new credit card as those whose credit histories are poor — but not quite. With no proof that you’ll be a bad borrower, some companies are willing to trust that you’ll be a good one, and offer you a good credit card deal.

Your First Credit Card

Getting your first credit card can be one of the hallmark occasions that mark your 21st birthday — assuming you did a little homework. Apply to carriers that advertise cards specifically for people with limited credit, or take advantage of the pre-qualification offers you see online or in the mail to increase your odds of approval.

If you’re having trouble getting approved for your first credit card, you may need to look to a parent or friend with good credit to help give your borrowing history a jump-start. Try becoming an authorized user on his or her account to establish yourself in the credit world, then reapply after a few months.

Student Credit Cards

Obtaining your first credit card can be easier if you are a college student who is actively enrolled in classes, as many of the major carriers will offer student credit cards aimed at first-timers heading off to school. The best student credit card deals will come with cash back offers and student-centered perks, such as bonus rewards for good grades.

Student credit cards are likely to come with relatively low limits, but should come with a competitive interest rate. Make sure to pay the card off every month, on time, to start developing a positive credit history.

4. Do I Need a Secured Credit Card?

When all else fails, you may need to try a secured credit card. Unlike a traditional unsecured credit card, a secured card requires you to put down collateral in the form of a cash deposit. Your deposit is kept in a secured account and is only used if you default on your debt. It will be returned to you if you close the account (with no balance) or upgrade to an unsecured card.

Secured credit cards are typically the easiest to qualify for because they’re backed by your deposit. The limit on your secured card will be equal to the amount you deposit, so if you plan to carry a balance, consider a larger deposit to keep your utilization rate low.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 5 minutes | N/A | Yes | 9.5 |

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 25.64% (variable) | Yes | 7.0/10 |

- 1% Cash Back Rewards on payments

- Choose your own credit line - $200 to $2000 – based on your security deposit

- Build your credit score.¹ Reports to all 3 credit bureaus

- No minimum credit score required for approval!

- ¹ Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 19.24% (V) | Yes | 7.5/10 |

When comparing secured credit cards, make sure to look for the card offering the best interest rate. You’ll also want your provider to report to all three credit agencies so you can get the most out of your credit building.

5. Are There Any Free Credit Cards?

The old saying “nothing in life is free” certainly holds true for most credit cards. Whether it’s balance transfer fees, annual fees, cash-advance fees, or interest charges, just about everything you do with your credit card is going to cost something.

The only real way to achieve the dream of a no-cost credit card is to combine the right card with the right habits. To start, paying your card balance in full each month can eliminate the largest chunk of the cost of credit card ownership — interest charges. You’ll also want to avoid using pricey services like cash advances.

Next, you’ll want to use a card that does not charge an annual fee. These cards are available in a wide range of categories and for most credit scores. The flip side to no annual fee, though, is the card will likely come with fewer perks than those that charge for the privilege of ownership. Granted, cards with annual fees are mainly available to those with good to excellent credit because of the extra perks they offer.

Another type of credit card some people consider “free” is the 0% introductory APR card. Generally, for those with mid-prime credit scores (650+), these cards offer 0% interest on new purchases for some initial term length — typically 6-12 months, though some are longer. Watch out for high interest rates once the initial terms wear off.

6. How Long Does it Take to Get a Credit Card?

The time it takes to get a credit card will vary depending on your situation. In many instances, getting approval for a credit card when you apply online will take just a few minutes, as many companies use a computerized system.

If you are on the edge of qualifying for the card, or something in your application was questionable, the computer may indicate your application needs to be reviewed by a human. In this case, it may be several days or even upwards of a week before you know if you were approved.

Once you are approved for the credit card, it’s just a matter of waiting for the card to come in the mail. Unlike the 19th century shoppers awaiting a new credit coin, your card won’t take weeks or months, but mere days to reach your mailbox. Don’t forget to call the number provided to activate your card.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.