Chapter 7 bankruptcy is designed to relieve you of unsecured debts, such as medical expenses. There is no rule that requires you to use a lawyer to file a petition. You can do the filing yourself, which is called “pro se,” but we recommend that you do your research first.

A pro se filing makes more sense if you have a relatively simple case without a lot of property or court-ordered obligations, such as child support. If your creditors are alleging fraud, you might prefer to use an attorney.

Here are the general steps you will have to take to file for Chapter 7 bankruptcy yourself:

1. Determine Eligibility

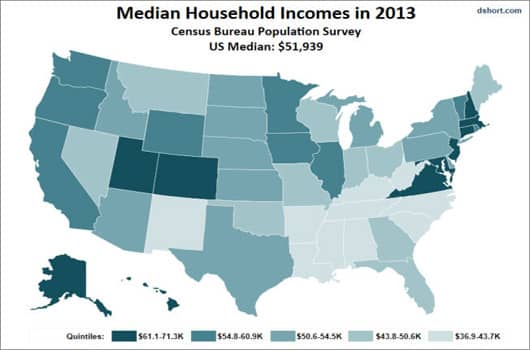

The law establishes limits on wealth, income and property for Chapter 7 bankruptcy. You will have to provide a full disclosure of your income, assets and debts for the court to evaluate before you can file for Chapter 7. First, use this calculator to determine if your income is less than the state median income – if so, move on to the next step.

2. Fill Out the Means Test

The means test is a set of three forms. The United States Courts website says:

“You must file 22A–1, the Chapter 7 Statement of Your Current Monthly Income (Official Form 22A–1) if you are an individual filing for bankruptcy under chapter 7. This form will determine your current monthly income and compare whether your income is more than the median income for households of the same size in your state. If your income is not above the median, there is no presumption of abuse and you will not have to fill out the second form.”

You must earn less than your state median income to qualify for Chapter 7 bankruptcy.

You should know by using the calculator above whether you qualify, but you will still need to fill out the 22A-1. Here are the three forms, in order:

3. Receive Credit Counseling

Another pre-filing hurdle requires you to receive credit counseling from an accredited source. You will also have to enroll in a financial management course to ensure you are educated about handling debt. You must file documents certifying you’ve met these requirements.

4. Fill Out Official Bankruptcy Forms

The primary form is the Voluntary Petition, Form B1. Take your time and fill in all of the requested information. Other forms include:

- List of unsecured creditors

- Schedules listing your real and personal property, creditors hold secured and unsecured debt, current income, current expenditures, contracts, leases, education/tuition accounts and more

- Statement of Financial Affairs, a multi-part questionnaire

- Statement of Intention

- List of Case Commencement Notes — a notice to creditors of your intent to file for Chapter 7

- A copy of any debt repayment plan you’ve worked out

All of these forms can be found at http://www.uscourts.gov

(Note: Married couples can file a joint Chapter 7 application. Businesses can file for liquidation via Chapter 7 bankruptcy, but this usually is best done with the help of an attorney.)

5. File a Petition

After you complete and assemble your papers, you file your petition with the federal court clerk and your case will be scheduled. Filing a Chapter 7 petition automatically stays any action by creditors, meaning they’re unable to continue calling you for payments or go forth with any lawsuits or wage garnishments. Filing a petition costs $335, unless you apply to have the filing fee waived.

The U.S Bankruptcy Court will appoint a trustee to oversee your Chapter 7 bankruptcy. The trustee will sell your “nonexempt” property and use the proceeds to partially pay back your creditors. You keep exempt property, such as your home, car, necessary clothing, pensions and public benefits. Of course, your bank can foreclose your house for mortgage nonpayment, and your car can be repossessed if you miss car loan payments, as these are not covered by Chapter 7.

6. Attend a Creditors’ Meeting

The trustee will schedule a meeting within 40 days of your filing. You will be put under oath and be asked questions. The trustee might try to work out a voluntary solution with creditors in order to avoid further Chapter 7 action.

The creditors’ meeting, also known as a 341 meeting, is where the trustee will ask you questions under oath about your financial situation.

Don’t worry, according to thebankruptcysite.org, these meetings typically only last about 1-2 minutes.

7. Attend Personal Financial Management Instruction Course

This must be done within 45 days of completing the creditors’ meeting, or you RISK HAVING THE CASE DISMISSED. Visit justice.gov to find a list of approved debtor education providers in your area.

8. Meet the Bankruptcy Court’s Requirements

After the 341 meeting, you will be presented with a list of requirements to satisfy before your case is closed, which typically takes between four and six months.

The court will provide you with a list of requirements that must be met before your case is closed.

Requirements include the financial management course above, as well as making any nonexempt property available to the trustee. Requirements are dependent on each case.

Final Thoughts

Be prepared for a lot of paperwork and financial documentation. Chapter 7 is a daunting, but doable, process. If you don’t want to use a lawyer, you might consider using a bankruptcy preparation service to help you fill out all the required forms.

Photo credits: bankruptcylawyer4denver.com, dshort.com, chriswesnerlaw.com,

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.