Understanding that you have opportunities to borrow money even if you have a poor credit score is important. Read on to discover your options before pursuing the right course of action for your circumstances.

Anyone can be faced with the sudden need to borrow money at any given time. Having bad credit undoubtedly complicates the challenge, but the good news is that loans for bad credit are available from multiple sources.

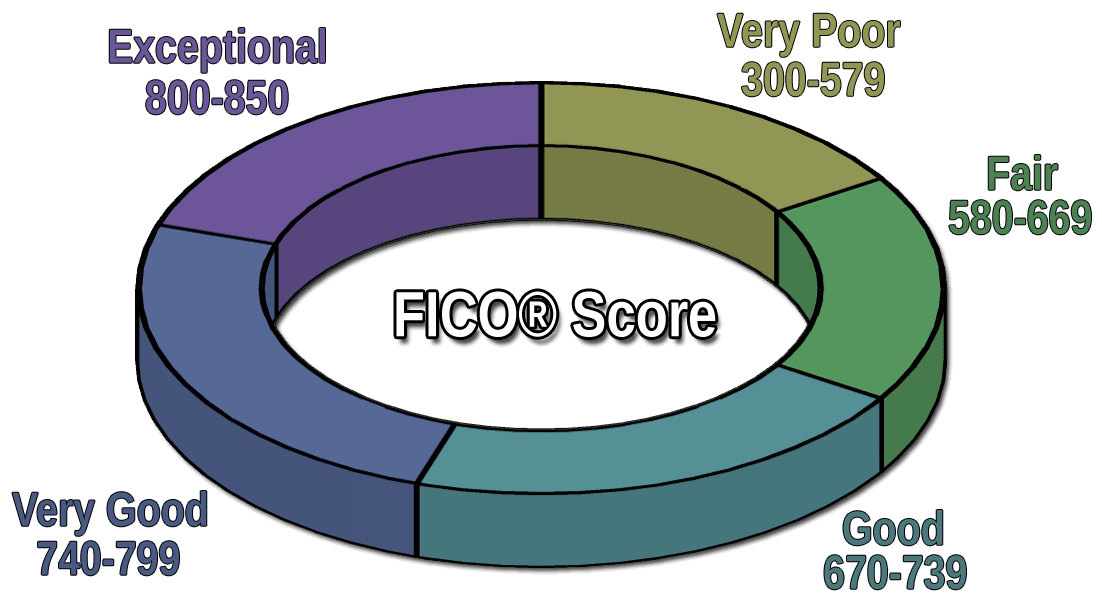

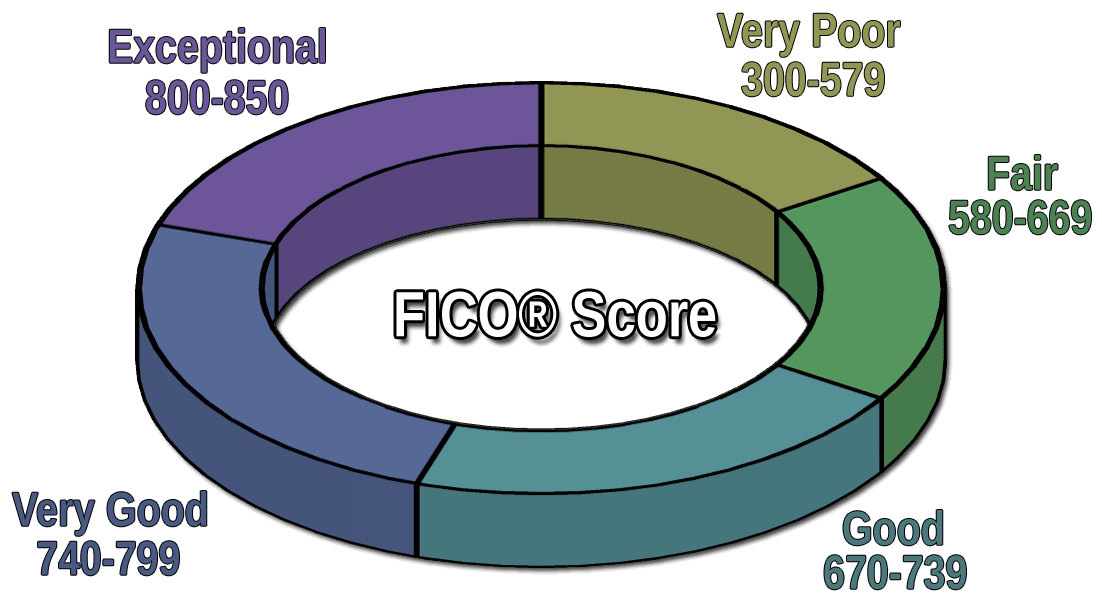

You have bad credit if your score is below 580 on the FICO scale of 300 (worst) to 850 (best).

Having bad credit makes it harder to borrow money, and you’re likely to be saddled with high interest rates, high fees, and limited loan amounts. While a low credit score increases a loan’s overall cost, the repayment term can be extended to make the monthly payments more affordable.

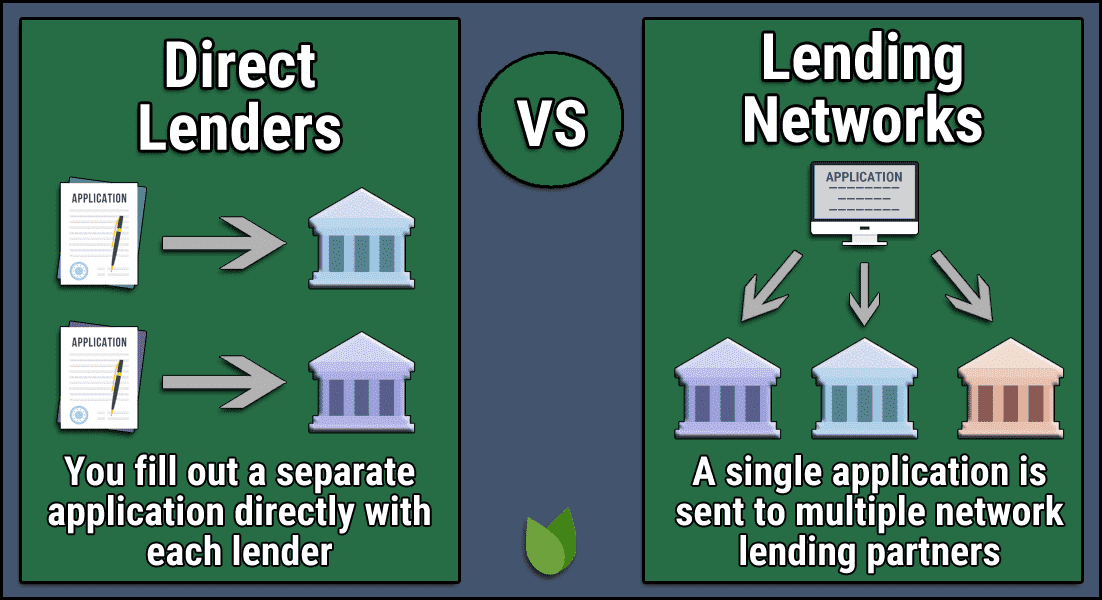

It’s difficult to qualify for a bank loan when you have bad credit. However, alternative sources of personal loans are specifically designed for subprime borrowers. The most efficient way to get this type of loan is by using an online lending network.

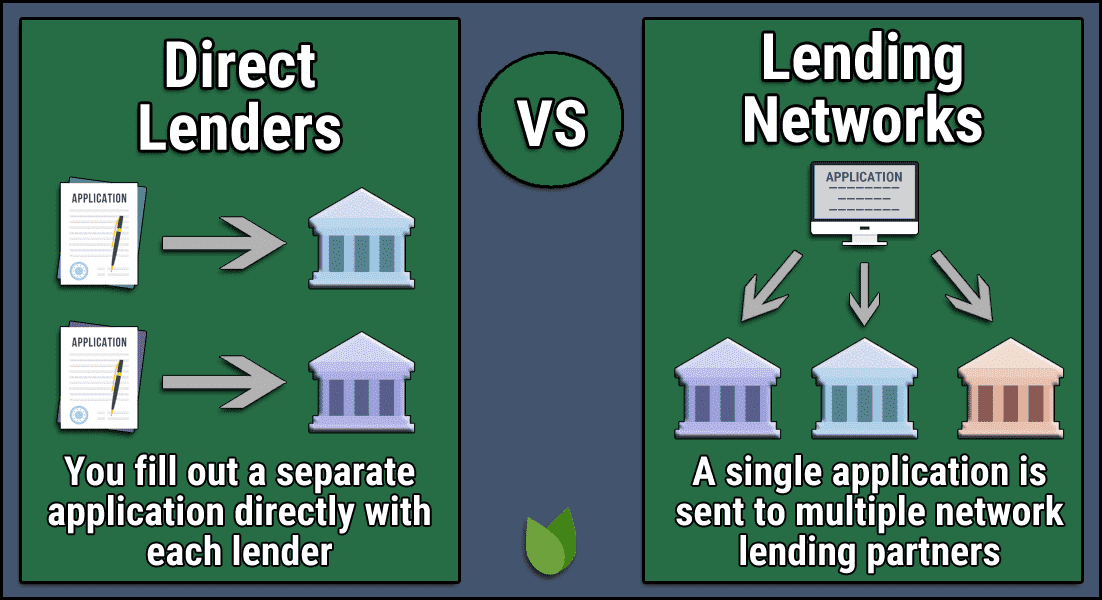

A bad credit lender-matching service works with a network of direct lenders that have extensive experience helping subprime borrowers. With this kind of service, you first prequalify for a loan by filling out an online request form on the service’s website.

The prequalification requirements are generally limited to the following:

- Age: You must be at least 18 years old.

- Citizenship: You must be a US citizen or resident.

- Income: You must reliably collect a specified minimum amount of income or benefits each month.

- Bank account: You must have an active bank or credit union account registered in your name.

- Identification: You must provide a Social Security number, valid email address, bank account details, and work and/or home phone numbers.

When you submit the loan request form, the matching service will identify the most appropriate direct lender and transfer you to the lender’s website. You then finish the application process by providing any additional information required.

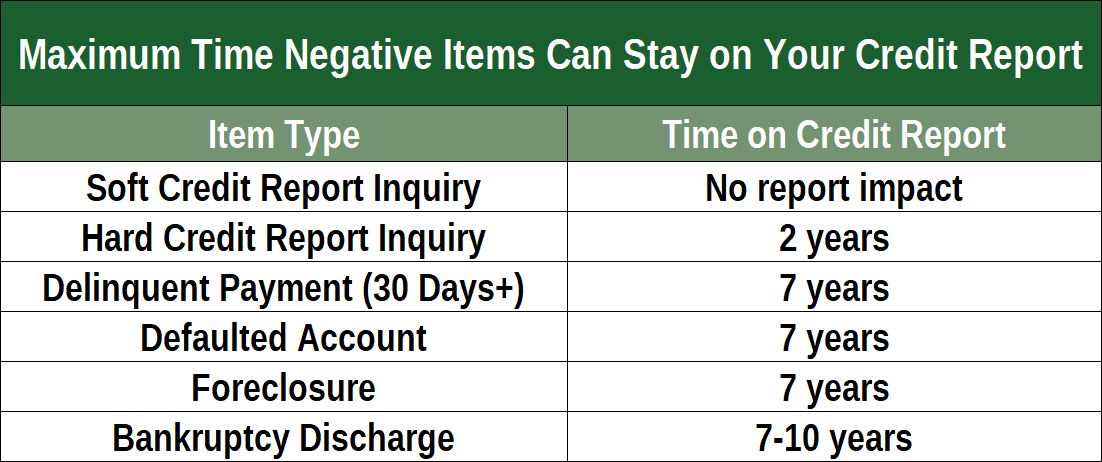

You may have to give the lender permission to access your credit report (a hard inquiry) from one of the major credit bureaus — Experian, TransUnion, or Equifax — unless you select a no credit check loan option. The lender will then retrieve your credit report, quickly evaluate your application, and give you a decision in seconds.

If your application is approved, the lender will provide you with a loan agreement that specifies all the loan rates and terms.

You should read and understand all the loan terms, including the interest rate and fees, before agreeing to accept the money. You’re under no obligation to accept the loan offer.

If you decide to accept a loan offer, you’ll need to complete the loan paperwork and e-sign the agreement. You should receive your loan proceeds as a cash deposit to your bank account within one to two business days. The lender may automatically debit your bank account to collect the loan payments.

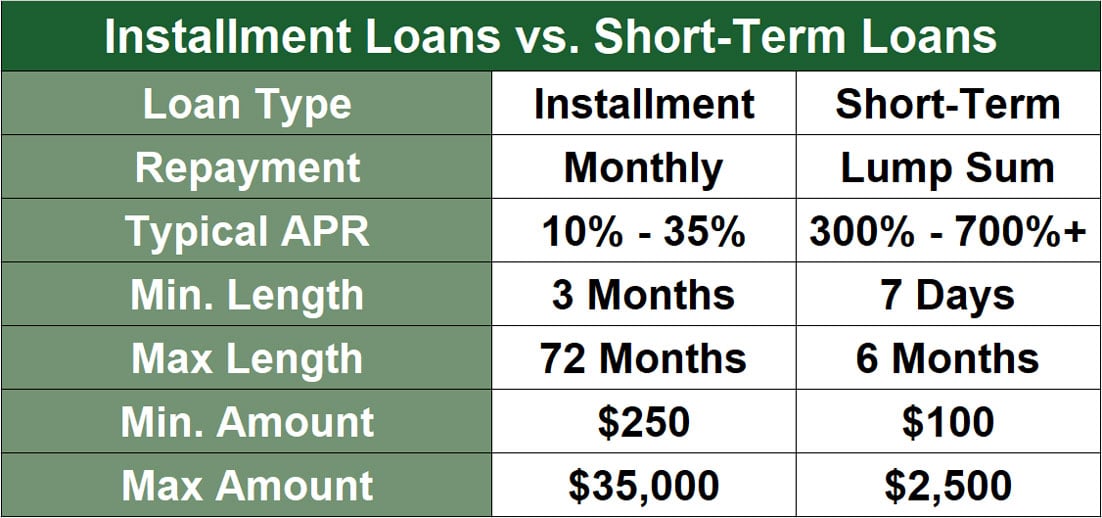

Generally, these loans are repaid in three to 72 monthly fixed installments. You can usually repay the loan without penalty. There is no charge to use a loan network.

Bad credit personal loans are the focus of this content. These are often called signature loans because you just need to sign your name on the loan agreement form to complete the transaction. They are unsecured loans, which means you don’t have to provide any collateral to secure this kind of loan, although many lenders will accept collateral if you would otherwise not qualify.

Other loan sources for folks with bad credit include:

Credit card cash advances: Your unsecured or secured credit card may allow you to take out a cash advance. The maximum amount you can borrow is usually some percentage of the card’s credit limit. Interest, which accrues daily starting on the transaction date, is usually higher than that of a personal loan.

The APR for credit card advances is also usually higher than the APR for purchases. The best thing about credit card advances is that they are available immediately without the need for approval. However, because these are expensive loans, they are best suited for short-term borrowing.

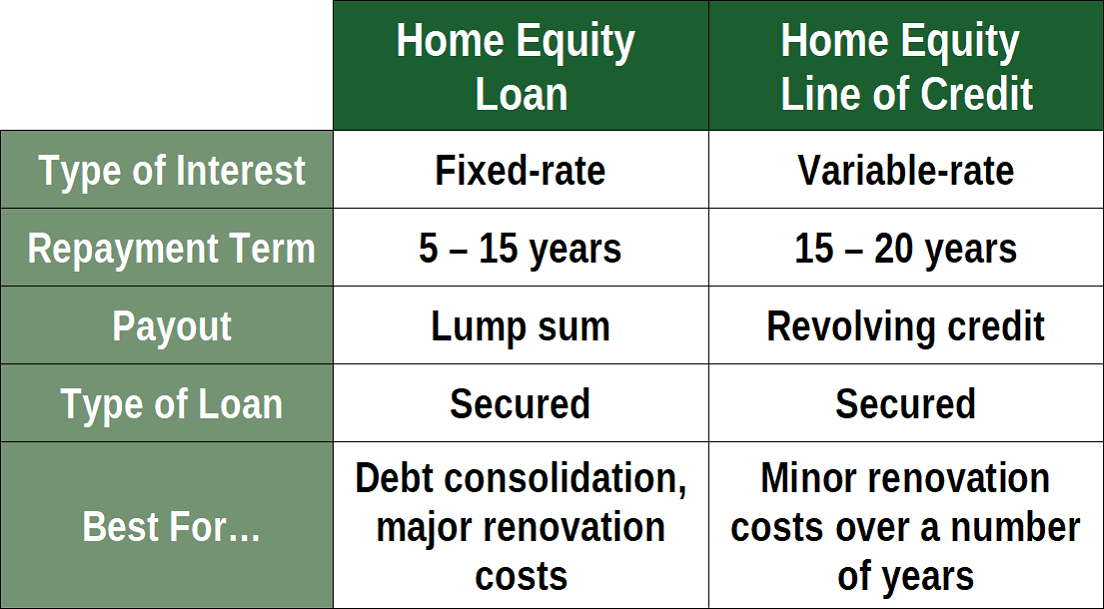

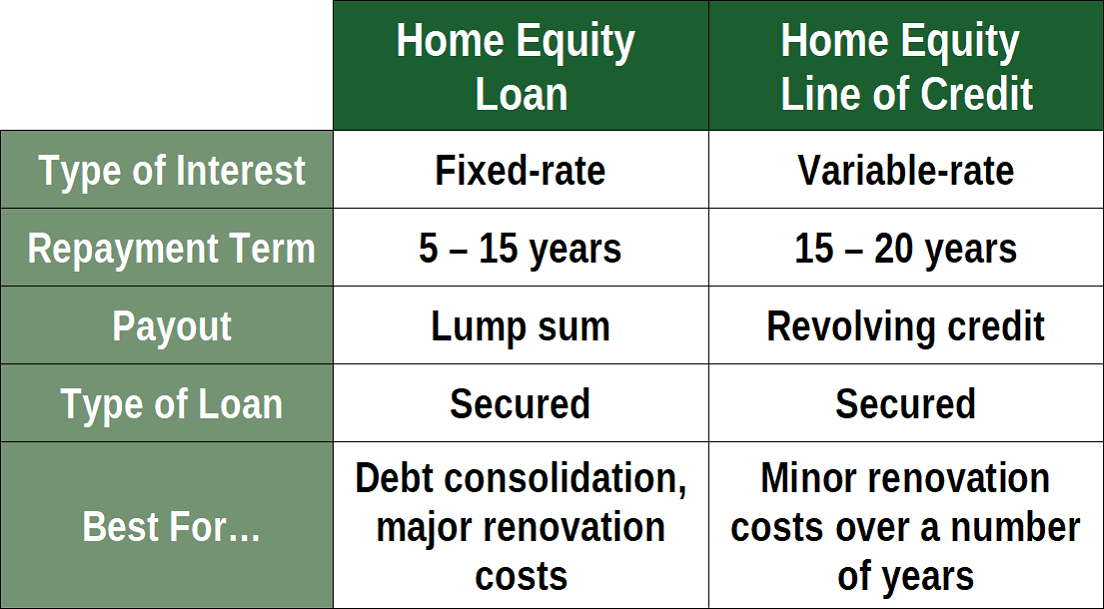

Home equity loans: If you own a home and have accumulated equity in it, you can unlock your equity through a home equity loan or home equity line of credit. Your equity is equal to the current value of your home minus the remaining amount of your mortgage. Banks and other sources will let you borrow some percentage of your equity, sometimes up to 95% to 100%.

A home equity loan is a lump sum amount that you repay over a set number of installments. If you miss payments, the lender can foreclose on your home, so these loans can be risky.

A home equity line of credit (HELOC) is a revolving credit account that is similar to a secured credit card cash advance except it is secured by your home.

Home equity loans are usually very cost-efficient and don’t depend primarily on your credit score. Hence, they are a good choice if you have bad credit. Of course, they won’t work for you if you don’t own your home.

Automobile cash-out refinancing: This is similar in concept to home equity loans, except that it is secured by your car rather than your home. These are refinancing transactions in which you borrow more than the balance due. You will get a new car loan to replace your current one, if any, with its own rates and terms.

If you miss payments, a repo agent may repossess your car. Otherwise, this type of loan is usually a good deal and is relatively insensitive to your credit score. Rather, your monthly income and expenses help determine whether you can afford the loan.

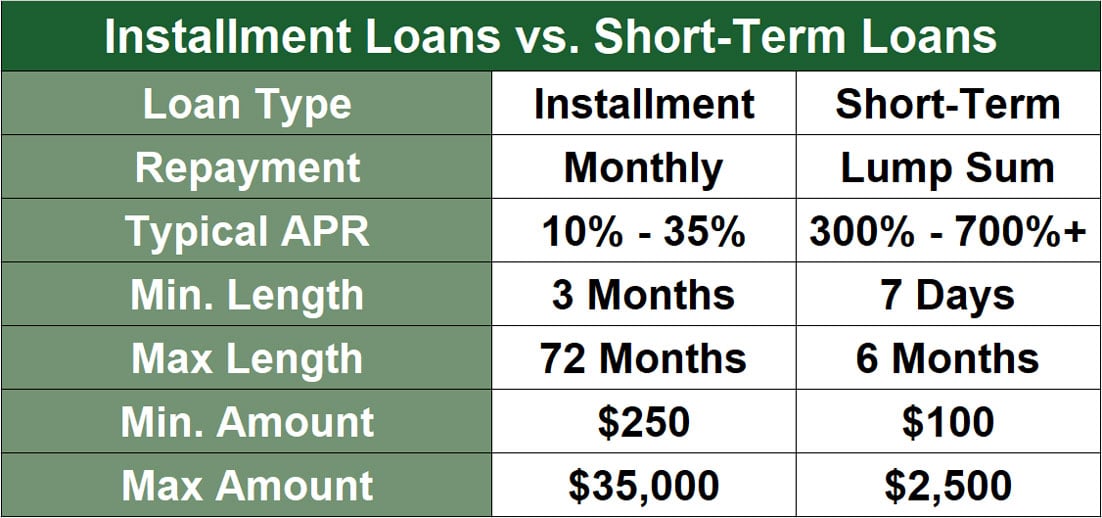

Payday loans: These are loans secured by your next paycheck that don’t require good credit for approval. Payday loans charge exorbitant interest rates and fees that can land you in a debt spiral. We recommend you instead use an online personal loan.

Pawnshop loans: You can borrow a small loan against personal belongings at a pawnshop. Typical pawn items include cameras, laptops, watches, and jewelry. If you don’t reclaim your property after a set period, the pawnshop can sell it. These loans are very expensive because you usually can only borrow a small percentage of the pawned item’s value, but it is a viable no credit check loan option.

Credit Builder Loan: This isn’t really so much a loan as it is an investment in your future. You don’t apply to borrow money, instead, you apply to make payments, usually to a credit union or other fintech service, that will be reported to the credit bureaus to help your build credit. The payments are returned to you after the loan term ends. Credit Builder loans provide a way to save money and improve your credit over a period of one to two years.

Family and friends: If all else fails, you may be able to borrow money from your family or friends. Often these will be low- or no-interest loans with flexible terms. However, you risk your relationship with the lender if you don’t repay the loan.

Payday advance apps: These apps provide a great way to quickly borrow money if you’re employed. You usually need a bank account to qualify, but you can link your account to the app and get an advance on your next paycheck for relatively cheap. Relying on these services often, however, may mean you’re overspending.

Consider these types of loans if you really must take out a bad credit personal loan to meet urgent expenses. Each has its merits and can be a suitable way to access the financial resources you need.

Consider your situation and how each of these loan types may best serve you. Each has a unique loan amount, loan term, origination fee, and minimum credit score requirement.

Cash Loans

Getting a cash loan from a lender or from a private source may be the most straightforward type of personal loan you can obtain. Cash loans may require some form of collateral or prearranged commitment to pay — either automatically, as is the case of a payday loan money transfer, or even via a post-dated check.

You may also be able to get a cash loan from a relative or someone you know, which may be a more preferred avenue. Chances are a friend or relative won’t perform a credit check or charge you an origination fee or penalties for missing a monthly payment.

If you do decide to borrow from a friend or relative, consider signing a personal loan agreement that spells out the terms of the loan — hopefully, one that features a lower interest rate than you would receive from a subprime lender.

Emergency Loans

Emergency loans are frequently associated with the workplace, in which you request an advance on future earnings or on accumulated vacation pay. If an employer offers such an option, this may be a viable alternative.

Emergency loans can also be requested and withdrawn from funds that you have contributed to, such as a 401(k), an individual retirement account, a healthcare flexible spending account, or a similar account.

Emergency loans are typically short-duration loans of between 30 and 90 days. The creditor, the borrower, and (if needed) the cosigner, should spell out the loan amount and loan terms clearly to ensure the emergency loan is good for all parties.

Installment Loans

An installment loan is simply a loan that is paid back over time in incremental (and usually equal) payments. Installment loans are typically used for purchases of big-ticket items such as furniture, vehicles, and even houses.

The average installment loan usually requires that the borrower have at least fair credit, but if your credit score is high enough to qualify, this may be a good option.

Military Loans

If you’re an active member of the military, you may qualify to take out a personal loan against future earnings. Active service members should check with their commands to see if this is an option for them.

Another type of military loan is a Veteran’s Administration loan (VA loan) for the purchase of a home. This type of military loan is available to anyone who has served and was honorably discharged from active service.

Because these loans are guaranteed by the government, they offer service members great terms and rates.

Wedding Loans

Getting married can be a huge expense. If you need cash to pay for some or all your wedding costs, you may want to consider a wedding loan.

What we’re really talking about here is a personal loan for the purposes of paying wedding expenses. Plenty of lenders will make loans to cover the costs of a wedding, and payments can sometimes be spread over as many as seven or eight years.

Of course, if you own a home already, tapping into your home equity line is another way to secure a wedding loan, probably at a lower interest rate.

Boat Loans

Buying a boat is a big expense, and you should consider carefully whether taking out a personal loan is in your best interest. However, if you’ve found a great deal on a boat and need a loan, some bad credit lenders will grant subprime boat loans for folks with less-than-perfect credit.

As with an auto loan, a boat loan may require you to make a substantial down payment, but if you have the means to do so, you could be the proud owner of a new boat. And, as with any loan, if you make payments on time, you could turn your poor credit into an excellent credit score over time.

Government Loans

The government offers different types of loans for several specific purposes through various agencies. Some examples of government loans include small business and business expansion loans, housing loans, student or education loans, farming loans, and even disaster relief or emergency loans.

To learn more about the specific government loan type you’re interested in, check with the appropriate agency or government-sponsored enterprise (GSE) responsible for issuing these loans.

Debt Consolidation Loans

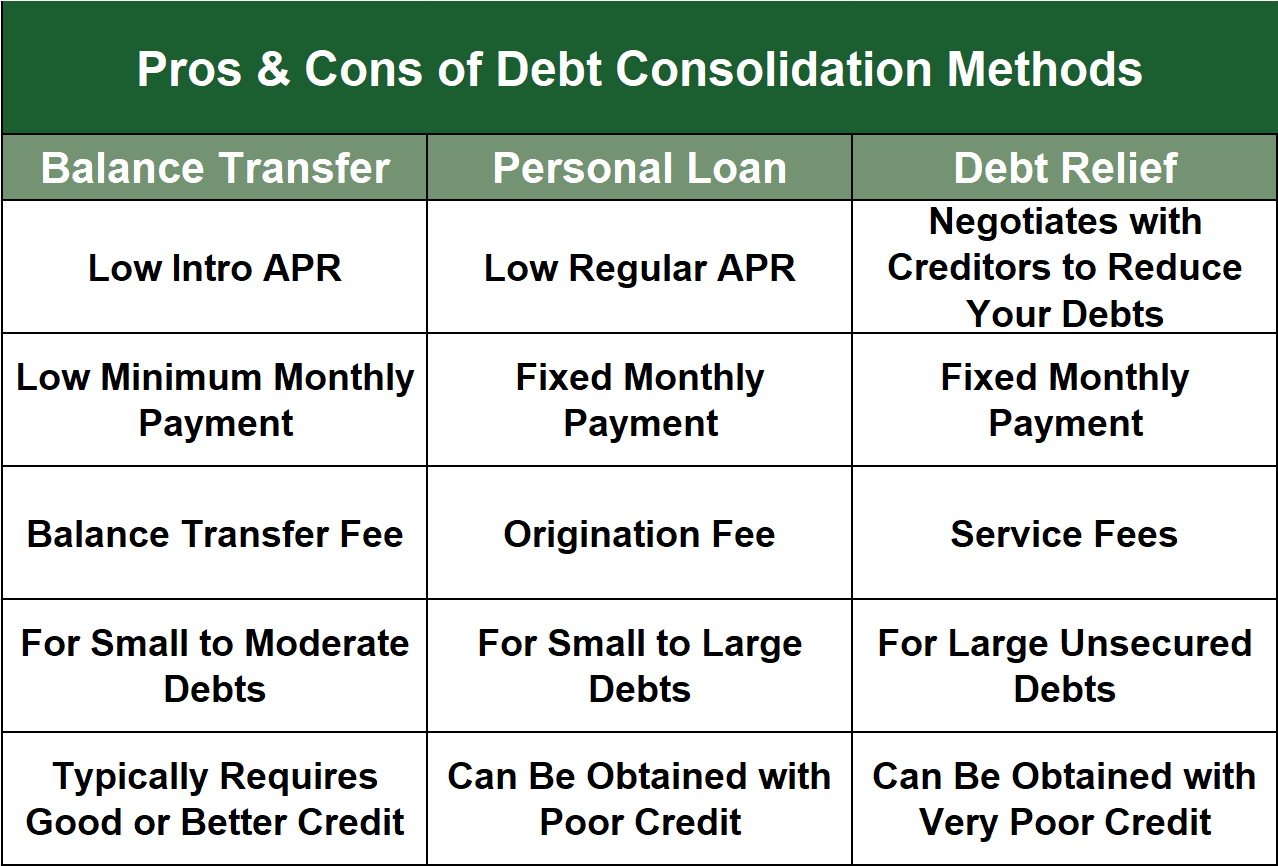

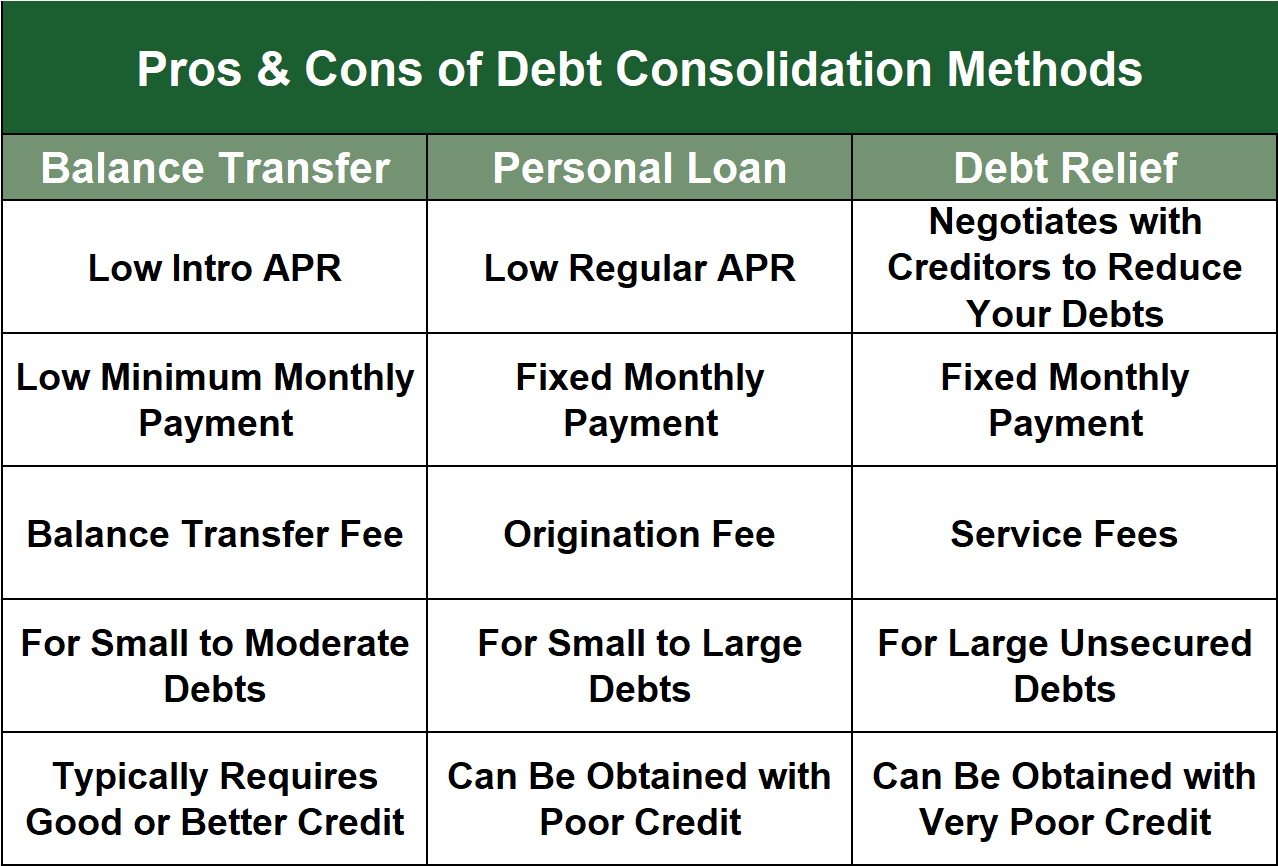

A debt consolidation loan is a type of personal loan that is typically used to pay off high-interest rate credit cards or other debt. As the name suggests, it’s a way to combine or consolidate your disparate debt payments into a single payment each month.

Use caution with this type of personal loan and only consider it if you can get a substantially lower overall interest rate. Also, if you choose to go the route of a debt consolidation loan, you need to have the discipline to stick to a budget and not add to your existing debt.

If you’re the borrower of an unsecured or secured personal loan designed to consolidate debt, getting into more credit card debt may create a hole you’re unable to climb out of.

It can be tempting to turn to any available source when you’ve got a bad credit score and are in need of cash. However, some subprime personal loans simply aren’t worth the risk.

Below is our list of the types of subprime personal loans you should avoid and why. Remember, better options may be out there for accessing the financial resources you need.

Private Student Loans

When you need a loan to pay for higher education, private student loans offer less flexibility than their government-backed equivalents.

Some examples of why private student loans are a poor choice include:

- They have variable interest rates that can suddenly rise.

- They offer no loan deferment, forbearance, or forgiveness like federal loans do.

- They are offered by institutions designed to make a profit.

Consider a federal student loan instead of one issued by a private lender. Some students with a poor credit score make the mistake of using a payday lender that charges a high interest rate and prepayment penalty to cover the cost of books and other living necessities. The repayment term from such a predatory lender makes this loan option a disastrous one, trapping students in a cycle of debt.

Small Business Loans

When you’re in need of cash to start, expand, or fund your small business, turning to a bank or lending institution for a small business loan can be tempting. You can also explore invoice financing or a merchant cash advance. However, this isn’t always a good idea.

Loans for small businesses can often come with high interest rates and exorbitant terms — especially if you have bad credit. Instead of invoice financing, a merchant cash advance, or something similar, consider a loan offered through the Small Business Administration.

This government-funded agency offers loans with reasonable rates and terms for things from expansion to short-term working capital.

Hard Money Loans

Hard money loans are often referred to as the loan of last resort for borrowers with bad credit. They are used when a conventional mortgage or home equity loan is impossible to get.

A hard money loan uses the value of a property as the collateral, but often with untenable terms. These loans are more expensive and have higher origination costs than a standard mortgage, VA loan, or FHA loan, making them impractical as a personal loan for most borrowers.

Commercial Loans

A commercial loan is money that is usually lent to a business instead of to an individual. These loans are also sometimes referred to as industrial loans or business loans.

They are usually secured by property — sometimes a personal residence — and are frequently used to fund business operations or expenses. These loans are usually short-term and can be very risky. For these reasons, commercial loans are a poor choice for a personal loan.

Bridge Loans

Bridge loans are loans designed to bridge a gap between the purchase of something and the permanent source of financing for it. Bridge loans are usually of very short duration. Because of this, they can charge an extremely high APR.

A bridge loan that charges 6% interest for a loan that comes due in three months can be more expensive than if you borrowed on a credit card. And, due to their short duration, they are not a wise choice as a personal loan.

Construction Loans

A construction loan is a loan type that is also usually short in duration. They are frequently used to pay for the costs of building a new home, after which you can apply for a standard mortgage, VA loan, or FHA loan.

The problem with many construction loans is that they can be expensive and risky. It used to be that small builders and developers could get their own financing and could lend the homeowner the money as part of the construction process. That went away to a great degree after the home mortgage meltdown.

Now, with the homeowner responsible for getting a construction loan, if anything goes wrong during the building process, they are on the hook.

College & School Loans

Different from federally backed student loans, college and school loans refer to obtaining a personal loan for education from a non-standard source. Alternative sources are frequently sought because government-backed lending programs don’t always cover the costs of a four-year degree.

Looking for college and school loans outside of the traditional methods can be very risky, as the interest rates are usually much higher, the terms are not as forgiving, and the penalties for default can be severe. If you are considering a personal loan for college or other school purposes, exhaust all the traditional methods first.

Even the best personal loans for bad credit do not have as low of an interest rate or loan forgiveness as federal student loans offer.

The personal loan company that consistently ranks highest at BadCredit.org is MoneyMutual. It is a lender-matching service that can quickly find you an unsecured personal loan of up to $5,000 despite a bad credit profile.

You can prequalify for a loan by completing a short loan request form. Because MoneyMutual doesn’t do a hard credit check, prequalifying will not damage your credit score.

To prequalify for a bad credit personal loan, you must be at least 18 years old with a bank or credit union account, and you must reliably receive income of $800+ per month.

Once you prequalify, MoneyMutual will transfer you to the most appropriate lender on its network where you complete the application process by providing additional information.

Upon approval, you e-sign a loan agreement and subsequently receive your money in one to two business days.

The following seven loan-matching services are equally easy to use:

They all share several characteristics that contribute to their ease of use:

- Quick prequalification: You fill out a short online loan request form that requires you to provide minimal data. In most cases, you can complete and submit the form within a few minutes.

- No hard inquiry for prequalification: You can prequalify for a loan without hurting your credit score because the lender-matching services do not perform a hard credit check when you submit the loan request form. This makes it easier to prequalify even if you have bad credit or no credit history at all.

- Easy prequalification requirements: Generally, you must be 18 or older, reside in the US, have a Social Security number, checking account, email, and phone number, and receive a minimal income each month.

- Automatic transfer to a lender: Upon submission of your loan request form, the service instantly matches you to the most appropriate lender on its network. The transfer is automatic, allowing you to continue the application process uninterrupted.

- Free service: The lender-matching companies charge no fees for their services and you are never under any obligation to take out a loan.

- Quick funding: If you agree to a loan, the money will automatically appear in your bank account within one to two business days. The process is easy, quick, and secure.

The direct lenders on these lender-matching services set their own rules regarding a borrower’s minimum credit score (if any), range of loan amounts, interest rates, fees, and repayment periods.

All the lender-matching services can find you loans of $1,000. The service most closely tied to small loans is CashAdvance, which can arrange a small personal loan of $100 to $1,000 despite your bad credit profile.

As with all the matching services, you fill out a quick loan request form to prequalify for a loan and then finish applying on the website of the lender matched to you.

The income requirement for CashAdvance is a minimum of 90 days of earning at least $1,000 a month after taxes. Your loan repayments are automatically transferred from your bank account to the loan account each month until the balance is paid. CashAdvance.com is not available in all states.

Bad credit complicates the process of obtaining a loan for your business. The lender-matching services discussed earlier specialize in personal loans rather than business loans. That being said, you can do several things to overcome obstacles standing between your business and a loan:

- Prepare yourself before applying: Part of applying for a business loan has to do with impressing the lender with your knowledge and professionalism. Gather and organize all the relevant information, including your business and personal credit reports, bank and financial statements, tax returns, and a business plan. Be ready to explain why you need the loan and exactly how you will use the funds.

- Apply to a traditional lender: You may be able to qualify for a small business loan from a traditional lender that works with businesses that have marginal credit.

- Focus on smaller institutions: Applying for a conventional loan at a regional or community bank, or at a local credit union, can considerably improve your chances. Be ready to make your case and to demonstrate you are of good character. If you are initially turned down, find out why and see what changes you can make to overcome the institution’s objections.

- Visit the website of the Small Business Administration (SBA): You may qualify for an SBA-guaranteed loan with competitive terms, lower down payments, no required collateral, and flexible overhead requirements. Loans guaranteed by the SBA as small as $500 are available. You can find an SBA loan program, such as the one for startups, that is geared to companies with bad credit.

- Get a business credit card: If your bad credit is preventing you from getting a business loan, apply for a basic business credit card. By paying your credit card bills on time, you can boost your business’s credit rating, thereby improving your chances for a regular business loan in the future.

Look upon the task of obtaining a business loan as a learning experience that encourages you to sharpen your critical thinking and your persuasive abilities.

Traditional lenders are members of the banking system, including banks, credit unions, and savings and loan associations. Alternative lenders are a variety of loan sources outside the banking system.

Frequently, the discussion of traditional versus alternative lending falls within the business loan context, but personal loans are also available from traditional and alternative sources.

The lending networks used by the personal lender-matching services include alternative lenders such as private finance companies that specialize in direct online loans to subprime borrowers. Another type of alternative lender is a peer-to-peer (P2P) online marketplace, such as Lending Club and Peerform.

Anyone can be a P2P lender, from wealthy individuals to consortiums of investors. Typically, P2P lenders do their own loan underwriting (i.e., risk assessment) that can use alternative methods for qualifying borrowers. Alternative methods go beyond credit ratings to assess the borrower’s employment and educational background.

The biggest downside of a P2P loan is that it may take longer to get your money than if you were to use a lender-matching network to obtain a direct loan.

Traditional lenders are typically the slowest lenders, but they do offer in-person guidance and assistance that may be lacking from an online lender. Also, if you can get a traditional loan despite having bad credit (which is not likely), you’ll probably get a good interest rate.

A secured loan is backed by collateral, such as cash, securities, your house, or your car. Credit cards are available in secured and unsecured varieties, whereas home loans and car loans are, by definition, always secured. Unsecured loans are backed only by your promise to repay and include student loans and personal loans.

When you take out a secured loan, you give the lender a lien on the collateral property securing the loan. The lien allows the lender to repossess the collateral if you default on the loan. In virtually all cases, the collateral’s value exceeds the loan amount, which helps defray the added legal and operational costs of liquidating the collateral.

Secured loans are often non-recourse, meaning the lender can seize only the collateral property when a borrower defaults. With recourse loans, lenders can sue borrowers who have defaulted for their personal property to recover the loan amount.

A secured loan can be recourse, meaning the lender can go after additional property if the collateral is insufficient to repay the loan (i.e., if there is a deficiency).

Foreclosures occur when homeowners default on their mortgages. When you default on your car loan, a repo agent can seize your vehicle. After the borrower liquidates the collateral, any amounts more than the loan (and associated costs) are returned to the borrower.

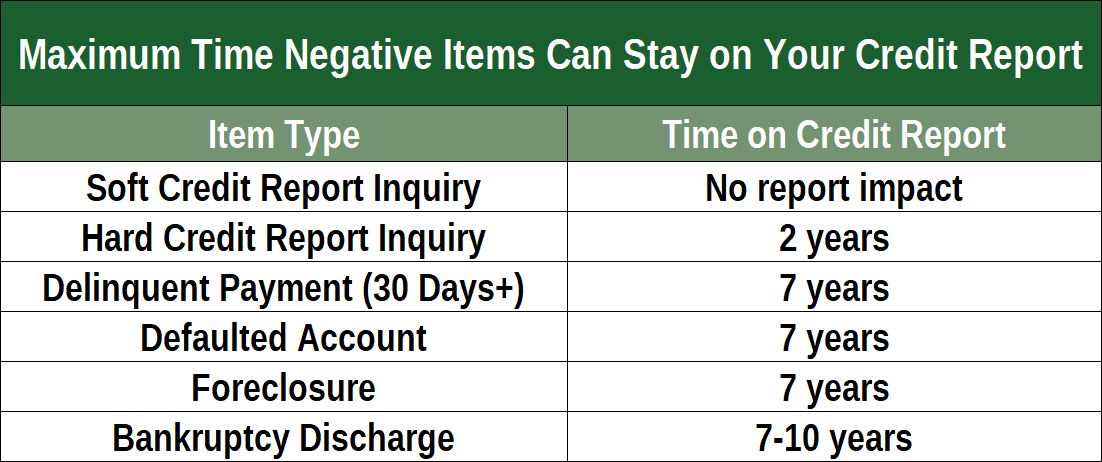

You can freeze creditor action by filing for bankruptcy. The court will then control your assets and how they are to be distributed to your creditors. The process is orderly, and you may emerge debt-free, but your credit rating will suffer for up to 10 years.

Typically, secured loans have lower interest rates than do unsecured ones. The reason is that secured loans are less risky, so the lender can afford to charge the borrower a lower rate. Most personal loans are unsecured, but banks and credit unions may offer personal loans secured by cash deposits and/or financial securities.

We think of instant loans as ones in which you receive a decision on your loan application within about 10 minutes of starting the process, although some may take more time or less. Fast decisions and next-day funding are some of the chief reasons why consumers apply for instant online loans.

BadCredit.org offers numerous reviews of online lenders, and that’s a great place to start. We examine the reputation and ratings of various lending services to award each one an overall rating. You can read our reviews, find a lender that interests you, and then click on the link to the lending company.

After clicking on the link, you’ll be transferred to the lending service’s website where you can do more investigating and complete a loan request form. The service will prequalify your request and then transfer you to a direct lender where you complete your loan application.

If approved, your loan proceeds will be deposited into your bank account in the next one to two business days.

The best way to increase your odds is to improve your personal credit score. One of the fastest ways to boost your score is to remove (either by your own efforts or through a credit repair company) erroneous or incomplete negative information from your credit reports. Cleaning up your reports can lead to higher scores within a couple of months.

Over the long run, your credit score should rise if you pay all your bills on time and you maintain relatively low levels of debt. One metric, your debt-to-income (DTI) ratio, measures your level of debt. Most lenders want to see a DTI ratio no higher than 36%, although you can get a government-backed mortgage with a DTI ratio as high as 43%.

If you have credit card debt, reduce your credit utilization ratio (i.e., total credit used divided by total credit available) below 30%. Your CUR accounts for 30% of your credit score, so paying down debt can help your score rise.

You may find it helpful to consolidate your credit card debt through 0% APR balance transfers, thereby letting you focus on paying off a single card balance.

Other things you can do to help your personal credit score are keeping old credit card accounts open, using a wide mix of loans and credit, and not applying for new credit more than once or twice per year. These are minor factors that go into the calculation of your FICO credit score. Another step you can take is to sign up for Experian Boost, a program that can add dozens of points to your score.

A credit score of 500 puts you squarely in the Very Poor credit category on the FICO scale and can severely limit your financing options. While it is possible to secure a personal loan with a credit score that low, the costs may outweigh the benefits.

You’ll likely pay the highest interest rate a lender can charge and perhaps even more fees on top of that. That means you could end up paying back far more than the initial loan amount.

Lenders need to charge such high interest rates because your lower credit score presents a higher risk to them. They want to get as much money back as early as possible in case you default later in the loan term.