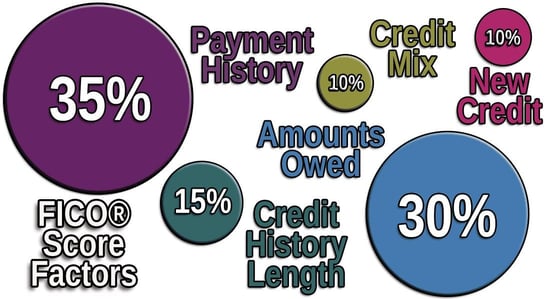

The following credit hacks to improve your FICO Score aren’t industry secrets — the five factors FICO uses to calculate its credit scores are public knowledge.

And yet, a LendingTree survey found that 37% of Americans polled don’t know how their credit scores are determined, so how would they know how to improve them?

Each of the “hacks” we share below is based on the real factors FICO uses in its credit scoring algorithm.

1. Pay Your Bills On Time

The most important factor as far as FICO is concerned is your payment history. Your payment history alone accounts for 35% of your FICO Score 8, the most widely used credit score by lenders. And by payment history, we mean whether you pay your bills on time.

You usually have 30 days before a creditor or lender can report your late payment to the credit bureaus — Experian, Equifax, and TransUnion. It is these reports that FICO uses for its credit scoring model.

A single late payment reported to these bureaus can cause your credit score to drop by as many as 100 points! That’s just how important it is to pay your bills on time every month.

If you stop paying altogether, this is called default, and it can really wreak havoc on your FICO Score. That’s because late payments are categorized by just how late they are, and the further you fall behind, the worse the impact is on your credit score.

And, in addition to credit score damage, you’re likely to incur late payment fees that make it even more difficult to get caught up with your payments.

The bottom line — always pay your bills on time, and if you can’t, reach out to your lender or credit card company as soon as possible to see how they may be able to help.

2. Request a Credit Limit Increase

If you have credit card accounts in good standing, you may qualify for a credit limit increase. A credit limit increase will decrease your credit utilization ratio.

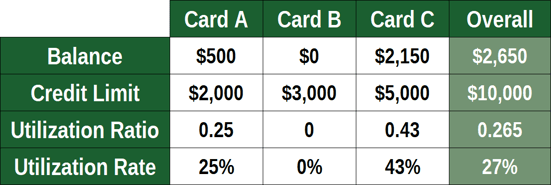

Your credit utilization ratio is the amount of credit you have used (money spent) divided by your total available credit. For example, a credit card with a $1,000 credit limit and a $500 balance has a 50% credit utilization ratio.

Your credit utilization ratio is tied to the second-most important factor of the FICO credit score calculation — amounts owed — which accounts for 30% of your FICO Score.

It is generally recommended to keep your credit utilization ratio below 30% to avoid credit score damage. However, the lower that percentage, the better it is for your scores. A credit limit increase is one way to lessen your credit utilization ratio if you don’t have the cash available to pay down your balance.

3. Pay Down Your Balances

This one may seem obvious, but as we just mentioned, how much debt you owe accounts for nearly a third of your FICO Score.

If you have the cash available to pay down your balances, you’ll see an improvement in your FICO Score the next time your credit report is updated with each credit bureau the account is reported to. Accounts are usually reported monthly, so you could see the benefits of paying down your balances within 30 days.

And the increase may be significant, depending on how much debt you have. You can use a credit score simulator tool to get an idea of how much your credit score may improve.

4. Transfer Your Balances to a New Card

If your credit is good enough to qualify for a balance transfer card (generally a 650+ FICO Score), you will:

- Possibly get a 0% interest rate for 12+ months to help you pay down your balances.

- Have access to more available credit, which will lower your credit utilization ratio.

It’s imperative that you not continue to spend on the card from which you transferred the original balance. This credit score hack only works if you lower your credit utilization ratio, which won’t happen if you continue to use the old card.

Also, note that most balance transfer cards charge a small fee of 3% to 5% of the amount transferred to take advantage of the promotional rate.

5. Avoid Closing Your Credit Accounts

Based on our last recommendation, you may think that closing your old credit card is the best way to prevent you from using it. But closing the account would cause you to lose your available credit line, which would lower your credit utilization ratio and hurt your credit score.

Try to keep old accounts open (unless they charge an annual fee that you want to get rid of) and use them sparingly so the issuer doesn’t close your account for inactivity.

6. Avoid Opening New Lines of Credit

This tip relates to two credit scoring factors: new credit and length of credit history, which account for a combined 20% of your credit score.

New credit relates to hard inquiries (credit checks), which are placed on your credit file each time a new lender or creditor pulls your credit report to make a lending decision, i.e., you apply for a loan or credit card. You’re generally allowed to have two inquiries on your credit reports before FICO reduces your credit score.

The reason behind this is that applying for several credit cards or loans within a short period may be viewed by lenders as risky behavior — that is, you may be in need of money.

The good news is that hard inquiries only remain on your credit report for two years and only impact your credit score for one year.

As for your length of credit history, FICO takes the average age of all your accounts when calculating your credit score. When you open a new account, the overall average drops. A long history of accounts in good standing is viewed favorably by lenders.

7. Open a New Line of Credit

OK, this suggestion conflicts with the above recommendation because of the aforementioned hard inquiries and length of credit history. However, opening a new line of credit can be advantageous to your FICO Score if:

- You’re new to credit and have a limited credit history.

- You don’t have any credit cards.

- Your chances of approval are high, and it will increase your available credit, thereby reducing your credit utilization ratio.

If you’re new to credit or don’t have any credit cards in your name, a new credit account can diversify your credit mix, which accounts for 10% of your FICO Score. And as you use your new card responsibly, i.e., keeping your credit card balance low and paying on time every month, your FICO Score will steadily rise.

As a credit newcomer, your best bet may be a secured credit card or a student credit card. And when you get your new card, remember to…

8. Spend Less Than 30% Of Your Available Credit

By now, you should be well-versed on the frequently aforementioned credit utilization ratio. If you’re approved for a new revolving credit line, the less you spend, the better it is for your credit scores.

Keep your balance well below your credit card limit — the general recommendation is a balance that is 30% or less of the available credit limit. But an even lower utilization ratio will mean higher credit scores.

And remember that this ratio applies to your combined card accounts. Here’s an example of credit utilization across three separate credit card accounts:

You should be able to achieve a good credit score within a few months by maintaining on-time payments and a low balance.

9. Use Experian Boost

Experian Boost is a free tool available to everyone. Its users report an average increase of 12 points to their Experian FICO Score 8. This is a great option for someone whose credit score is teetering on the edge of good credit.

It works by letting users add recurring bills to their payment history that aren’t reported to the credit bureaus. For example, your streaming accounts (Netflix, Disney+, etc.) and phone bill aren’t reported to the bureaus, so making your monthly payment on time doesn’t help your credit score.

But you may see a bump in your Experian FICO Score by adding these accounts to your Experian credit report.

Experian Boost uses a simple three-step process:

- Link your bank account to the software.

- Choose and verify which accounts you want to add.

- View your results.

Of course, the drawbacks are that you must have a bank account to be eligible to use the service, and you must also have recurring bills with a track record of on-time payments to reap any benefits.

10. Fix Credit Report Errors

Despite an old study from the Federal Trade Commission that found that 1 in 5 credit reports contained errors, your credit reports are actually accurate 98% of the time. However, that doesn’t mean errors don’t exist — and if you’re among the 2% of consumers who have errors on their credit reports, they need to be corrected.

First, get copies of your credit reports from AnnualCreditReport.com. You can get one free copy from each credit bureau. Check it for any errors, including incorrect balances, misspellings of your name or incorrect contact information, accounts you don’t recognize, or unauthorized inquiries.

Then, contact each credit bureau to have the information corrected. The bureaus have 30 days to respond to your dispute. If contacting each credit reporting agency to dispute errors sounds daunting, you can hire someone to help you.

Here are our top recommendations for credit repair services:

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

Hiring a credit repair service isn’t exactly cheap, but it can be well worth the cost, especially if you have multiple errors or accounts you wish to dispute with the credit bureaus.

11. Request Goodwill Deletions With Creditors

This is a service a credit repair company can help with, but it is also something you can do on your own. A goodwill deletion is an agreement between you and a data furnisher — a lender, credit card company, or any other company that reports payments, such as a cellphone bill that was never paid and subsequently reported to the bureaus.

If you paid late or stopped paying your loan, credit card, or service agreement, the account was likely reported as late or charged off to the credit bureaus. And this negative mark can significantly harm your credit rating.

But if you now have the money to pay the account, you can reach out to the company and request a pay-for-deletion arrangement.

As its name suggests, a pay for deletion means you pay the data furnisher in exchange for it removing the account from your credit report. You have better odds of this working if it is a one-off late payment, and you otherwise have a good history with the company.

But if the account was written off as a loss and it’s been several months (or even years) since the event was reported, it may be harder to make this kind of arrangement. It is at the lender’s discretion whether it will do this for you. And be sure to get the agreement in writing to hold them accountable for their end of the deal.

12. Become an Authorized User on Someone Else’s Card Account

If you have bad credit, becoming an authorized user on someone else’s credit card can provide a near-immediate boost to your credit score. The caveat is that this is only beneficial when:

- The credit card account is in good standing.

- The credit card doesn’t have a high balance.

- You don’t rack up credit card debt on the account.

Becoming an authorized user on someone else’s credit card account means you’ll receive your own card with access to the same credit line as the primary account holder. But only the primary account holder can make changes to the account, such as requesting a credit limit increase.

The account will appear on your credit reports, including the payment history and balance, and be reflected in your next credit score update.

This is a great credit hack for someone new to building credit, particularly young adults who can be added to their parent’s accounts. It’s also useful for someone with poor credit who has a friend or family member willing to help them out.

13. Open a Credit Builder Account

A credit builder account works like an installment loan. You make a monthly payment to a credit union or financial services company that provides these types of loans. That payment is then reported to the credit bureaus to help you build a positive payment history.

A credit builder account differs from an installment loan in that your money is returned to you at the end of the loan term — the lender doesn’t keep your money as it would with a traditional loan. So while you make monthly payments over the course of a year or two, that money is held in a savings account that may earn dividends.

And, if you’re unable to keep up with the payments, the account is closed, and your money is refunded — the credit union or loan servicer won’t report a late payment to the bureaus and hurt your credit.

A credit builder account is a great way to build credit and build up a savings nest egg. You can find a credit union near you to see whether it offers credit builder loans.

14. Prioritize Student Loan Debt

If your financial life is in distress and you’re contemplating bankruptcy, you should know that it is extremely difficult to get student loans discharged in bankruptcy court, for now at least.

When you default on a loan, the defaulted account typically ages off your credit reports after seven years from the date of the late payment.

However, there is one type of student loan — the Federal Perkins Loan — that will remain on your credit report until it is repaid.

“The special treatment of a Perkins loan was a provision of the Higher Education Act. Perkins loans are distributed by colleges, and they are a need-based type of loan, with interest deferred while the student is still in school. No other type of student loan delinquency stays on your credit report until the loan is paid off,” according to credit expert Gerri Detweiler.

In short, you can’t avoid Federal Perkins Loan debt, and the credit damage from late or missed payments may continue to haunt your credit file. It will be nearly impossible to achieve an excellent credit score with a lingering account in default.

15. Wait It Out

This isn’t really a credit score hack so much as a general suggestion, particularly if you’re young. Your length of credit history accounts for another 10% of your FICO credit score calculation. The general consensus is that a “good” length of credit history is seven years.

That means if you just opened your first credit card a year ago, you just have to give it time and use your card responsibly in the meantime.

Most negative information on your credit reports ages off within two to seven years, with some bankruptcies remaining for as long as 10 years.

But the more time that passes after a negative item is reported to a credit bureau, the less its effect on your credit rating. Waiting for negative items to age off your credit report will naturally help your credit score improve, but this isn’t practical advice if you need a quick boost, say if you’re applying for an auto loan or a personal loan soon and want a lower interest rate.

Now It’s Time to Apply These Credit Hacks to Improve Your FICO Score

You’re now well-armed to do battle with FICO. Just kidding. Despite what you may believe, FICO isn’t out to get you.

Your credit score is a direct reflection of your financial behavior and how long you’ve been managing loans and credit cards. It’s unlikely that all 15 of these credit hacks apply to your particular situation, but employing just one may help your FICO Score the next time your credit reports are updated, which is usually monthly.

You don’t need a perfect credit score to get the best interest rates and terms, but a score above 700 will certainly lessen your overall cost of borrowing money.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.